The institutional discovery layer for verified crypto quantitative strategies.

Unified data. Direct access.

Stop evaluating strategies in mismatched formats and unverifiable screenshots.

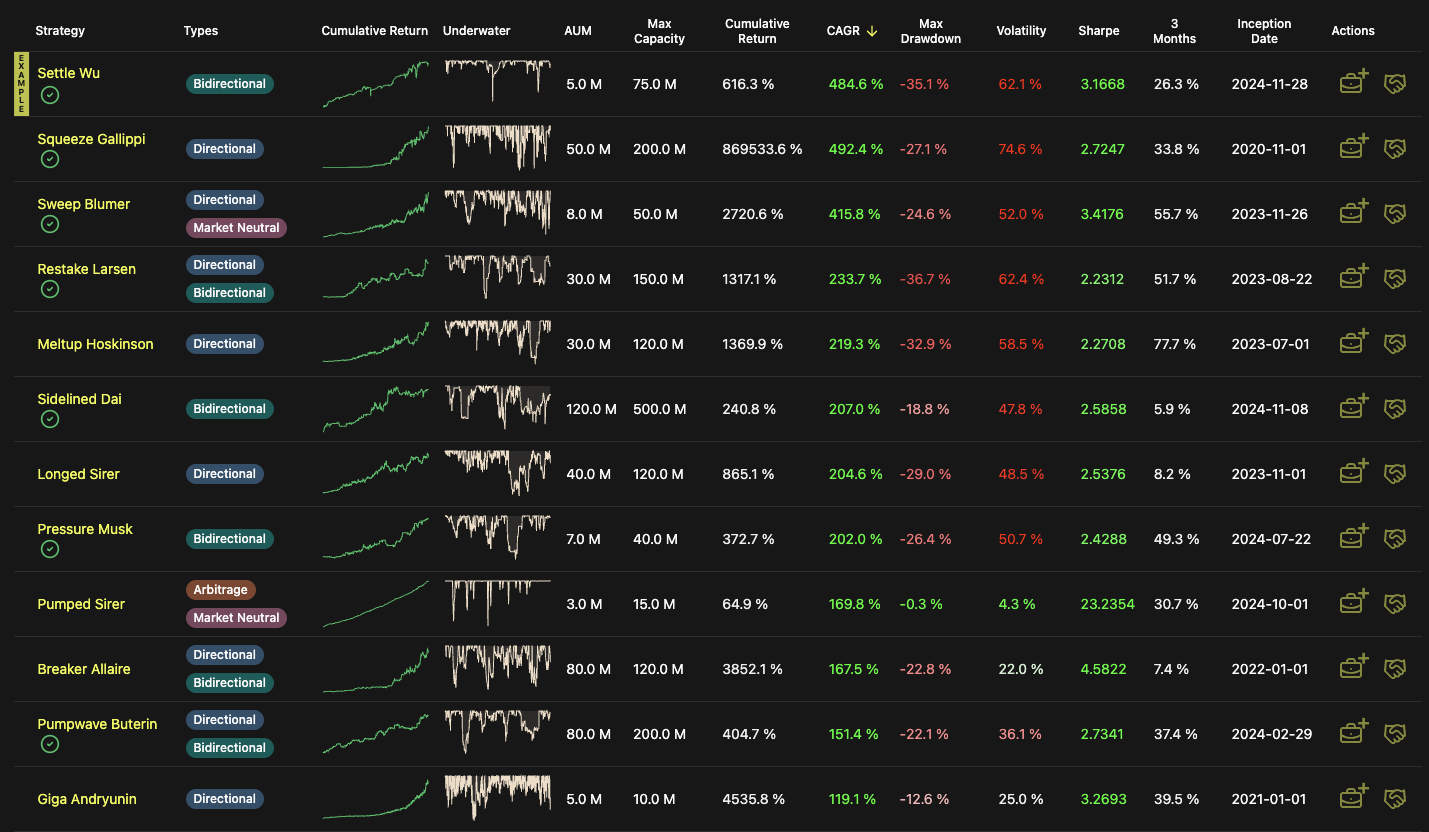

quants.space standardizes track records, surfaces comparable risk metrics, and lets you shortlist teams with allocator-grade materials — fast.

For Allocators

Build allocator-grade portfolios — without giving up custody. Analyze correlations, monitor performance in real time, and allocate using institutional-grade structures.

Strategy comparison

Screen and compare strategies on risk, returns, drawdowns, and correlation

Portfolio diversification

Analyze portfolio overlap and diversification in minutes

Real-time monitoring

Monitor performance in real time with standardized reporting

Custody-first allocation

Maintain custody through secure sma-style allocation structures

For Trading Teams

Get verified. Get visible. Get allocated.

Turn a real, validated track record into institutional distribution.

Allocator-ready reporting

Generate professional tearsheets in minutes

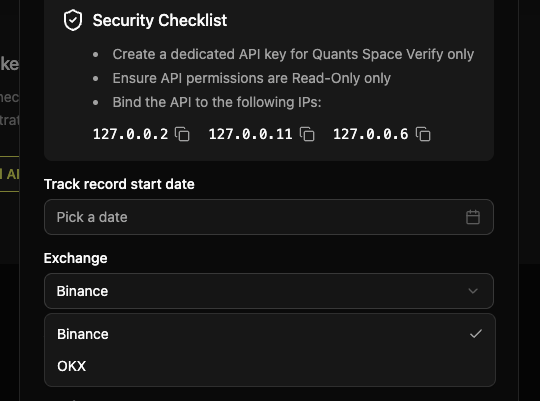

Verified performance

Verify results with read-only exchange keys

Allocator access

Get in front of active allocators looking for systematic crypto exposure

Fast speed to capital

Replace months of back-and-forths with instant interest from serious allocators

Why quants.space

The verification and distribution layer for crypto quant strategies.

100 +

Total crypto SMA teams

2 B+

Allocators network AUM

3 B+

Teams cumulative AUM

1 hour

Average time to onboard

20 days

Avg time to allocation

How it works

Verify

Connect read-only keys and validate reporting inputs

Standardize

Publish a track record in a consistent, allocator-ready format

Analyze

Compare strategies and construct portfolios with correlation tools

Connect

Book intro calls and run deeper due diligence off-platform